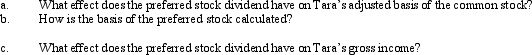

Tara owns common stock in Taupe,Inc.,with an adjusted basis of $250,000.She receives a preferred stock dividend which is nontaxable.

Definitions:

Interest

The price paid for borrowing money, often expressed as a percentage of the principal amount over a certain period.

Net Present Value

A financial metric that calculates the current value of a series of future cash flows by discounting them back to the present time.

Interest Rate

The part of a loan that accrues interest for the borrower, customarily denoted as a yearly percentage of the loan's outstanding sum.

Inflationary Premium

The portion of investment returns or interest rates that compensates for expected inflation, protecting the purchasing power of money.

Q19: Tonya is a cash basis taxpayer.In 2013,she

Q38: Heather's interest and gains on investments for

Q44: The release of a valuation allowance may

Q58: Which of the following would be included

Q61: Maroon Corporation expects the employees' income tax

Q71: During 2013,Jackson had the following capital gains

Q84: In 2013,Juan,a cash basis taxpayer,was offered $3

Q97: Maud exchanges a rental house at the

Q106: Abby exchanges an SUV that she has

Q172: Shontelle received a gift of income-producing property