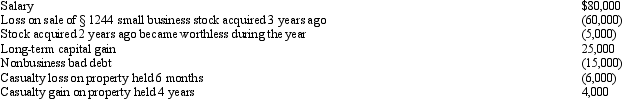

Maria,who is single,had the following items for 2013:

Determine Maria's adjusted gross income for 2013.

Determine Maria's adjusted gross income for 2013.

Definitions:

Money Purchase Plan

A type of defined-contribution retirement plan in which the employer's annual contributions are fixed and determined by formula.

Flexible Spending Account Plan

A benefit plan that allows employees to set aside pre-tax dollars for eligible expenses, such as medical or dependent care expenses.

Employee Retirement Income Security Act

The Employee Retirement Income Security Act (ERISA) is a federal law that sets minimum standards for retirement and health benefit plans in private industry to protect individuals in these plans.

Pension Plan Trustees

Individuals or a group of individuals who hold responsibility for managing and overseeing the assets and operation of a pension fund.

Q14: "Permanent differences" include items that appear in

Q15: Karen owns City of Richmond bonds with

Q27: In 2013,Frank sold his personal use automobile

Q30: A tax professional need not worry about

Q68: Subchapter D refers to the "Corporate Distributions

Q94: Ken has a $40,000 loss from an

Q97: In 2013,Mark has $18,000 short-term capital loss,$7,000

Q130: What requirements must be satisfied to receive

Q176: To qualify for the § 121 exclusion,the

Q222: For each of the following involuntary conversions,determine