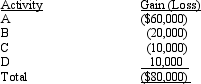

Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Definitions:

Same-sex Parents

Couples of the same gender who are raising children together.

Offending

The act of committing a crime or a breach of a rule or law.

Blended Families

Families formed by the merging of individuals with children from previous relationships, creating a new family unit.

Lesbian Partners

Two women in a romantic and committed relationship with each other.

Q30: A tax professional need not worry about

Q43: For the current year,David has salary income

Q52: The taxpayer should use ASC 740-30 (APB

Q57: In recent years,Congress has been relatively successful

Q66: Which tax-related website probably gives the best

Q77: A deferred tax asset is the expected

Q81: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q131: In the current year,Oriole Corporation donated a

Q162: Milton purchases land and a factory building

Q167: Rob was given a residence in 2013.At