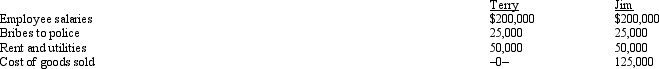

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Management Decisions

The process by which management selects among available options to guide the operations and set the strategic direction of an organization.

Full Capacity

The maximum level of output that a company can sustain to generate products or services under normal operating conditions.

Special Price

A temporary discounted offer or a negotiated price lower than the usual list price, often used to stimulate demand or reward customers.

Variable Costs

Costs that vary directly with the level of production or the volume of services provided.

Q32: Yahr,Inc.,is a domestic corporation with no subsidiaries.It

Q60: Emily is in the 35% marginal tax

Q60: On September 3,2012,Able,a single individual,purchased § 1244

Q68: While she was a college student,Angel lived

Q76: PaintCo Inc.,a domestic corporation,owns 100% of BrushCo

Q77: Taylor inherited 100 acres of land on

Q92: Flora Company owed $95,000,a debt incurred to

Q133: In Lawrence County,the real property tax year

Q138: Tired of renting,Dr.Smith buys the academic robes

Q156: Wade is a salesman for a real