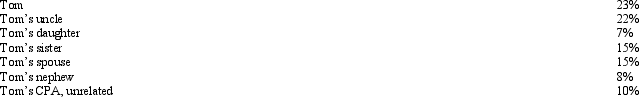

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom's realized loss is $13,000.

Definitions:

Absolute Class Frequency

The number of data points in a dataset that belong to a specific category without considering any relative measures.

Relative Class Frequency

The proportion of observations within a statistical data class compared to the total number of observations.

Observations

The individual data points or measured instances collected during a study or experiment.

Frequency Distribution

A mathematical function showing the number of instances in which a variable attains each of its possible values.

Q2: A valuation allowance reflects uncertainty that the

Q46: Mauve Company permits employees to occasionally use

Q48: George,an unmarried cash basis taxpayer,received the following

Q48: In 2013,Kipp invested $65,000 for a 30%

Q71: In 2012,Robin Corporation incurred the following expenditures

Q84: Sick of her 65 mile daily commute,Edna

Q105: Nigel purchased a blending machine for $125,000

Q111: Cream,Inc.'s taxable income for 2013 before any

Q117: Pat sells a passive activity for $100,000

Q121: Under the Federal income tax formula for