Essay

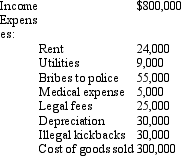

Albie operates an illegal drug-running business and has the following items of income and expense.What is Albie's adjusted gross income from this operation?

Definitions:

Related Questions

Q18: Carla is a deputy sheriff.Her employer requires

Q23: The amount of a loss on insured

Q58: If a taxpayer exchanges like-kind property under

Q63: Janet,who lives and works in Newark,travels to

Q64: Nikeya sells land (adjusted basis of $120,000)to

Q130: What requirements must be satisfied to receive

Q155: If the alternate valuation date is elected

Q168: When lessor owned leasehold improvements are abandoned

Q175: Dennis,a calendar year taxpayer,owns a warehouse (adjusted

Q213: The nonrecognition of gains and losses under