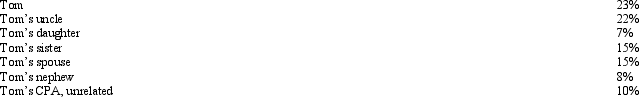

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom's realized loss is $13,000.

Definitions:

Inferior Good

A type of good for which demand decreases when consumer income rises, unlike normal goods where demand increases with rising income.

Chili Peppers

Fruit of plants from the genus Capsicum, used worldwide as a spice or vegetable, known for their hot and spicy flavor.

Daily Aspirin

A regimen of taking aspirin every day, often recommended to reduce the risk of heart attack or stroke.

Heart Attack

A medical emergency that occurs when the flow of blood to the heart is blocked, causing heart muscle damage or death.

Q27: In 2013,Frank sold his personal use automobile

Q28: Individuals can deduct from active or portfolio

Q62: If qualified production activities income (QPAI)cannot be

Q63: A nonbusiness bad debt deduction can be

Q74: If a taxpayer operates an illegal business,no

Q94: Under what circumstances may a taxpayer deduct

Q95: Last year,taxpayer had a $10,000 nonbusiness bad

Q104: With respect to the prepaid income from

Q105: In 2013,Tan Corporation incurred the following expenditures

Q112: Percentage depletion enables the taxpayer to recover