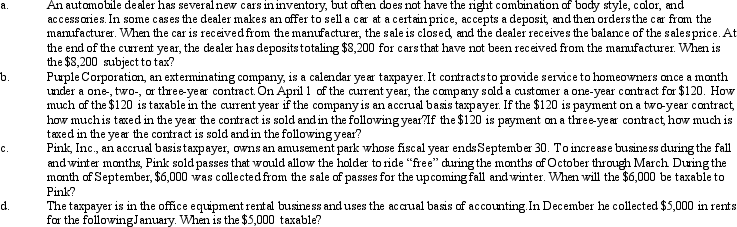

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Strategic Importance

The significance of a plan, decision, or action in achieving long-term objectives and maintaining competitive advantage.

Finite Capacity Scheduling

A method for planning and controlling production where the limited availability of resources (machines, labor, etc.) is taken into account.

Instantaneous Changes

Rapid alterations in a system or process that occur in a nearly zero time frame, often used in physics to describe acceleration or in finance for stock price movements.

Rule-Based Scheduling

A method of organizing tasks or operations based on a set of predetermined rules to optimize performance or resource allocation.

Q8: Arnold is married to Sybil,who abandoned him

Q16: On June 1,2013,James places in service a

Q18: Black,Inc.,is a domestic corporation with the following

Q23: Clara,age 68,claims head of household filing status.If

Q30: A tax professional need not worry about

Q36: The limit for the domestic production activities

Q50: Josh has investments in two passive activities.Activity

Q69: Qute,Inc.,earns book net income before tax of

Q135: Bonnie purchased a new business asset (five-year

Q146: Which,if any,of the statements regarding the standard