Essay

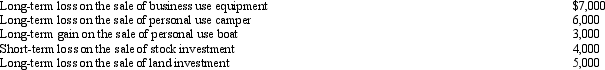

During the year,Irv had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Definitions:

Related Questions

Q11: Determine the proper tax year for gross

Q29: Contributions to a Roth IRA can be

Q45: The "petitioner" refers to the party against

Q57: Swan Finance Company,an accrual method taxpayer,requires all

Q76: Rex,a cash basis calendar year taxpayer,runs a

Q82: One of the tax advantages of being

Q119: Briefly describe the charitable contribution deduction rules

Q144: The tax law specifically provides that a

Q147: During 2013,Ted and Judy,a married couple,decided to

Q149: Many taxpayers who previously itemized will start