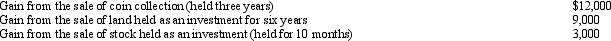

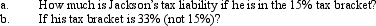

During 2013,Jackson had the following capital gains and losses:

Definitions:

Treasury Stock

Shares that were once outstanding in the stock market but were bought back by the issuing company.

Paid-In Capital

Paid-in capital refers to the funds a company has garnered from its shareholders through the sale of stock shares.

Treasury Stock

Shares that were issued and subsequently reacquired by the company, held in the company's treasury and not considered when calculating earnings per share or dividends.

Par-Common Stock

The face value of common stock as stated in the corporate charter, which may differ from its market value.

Q15: Nell sells a passive activity with an

Q34: a. Orange Corporation exchanges a warehouse located

Q45: For the following exchanges,indicate which qualify as

Q48: Liam just graduated from college.Because it is

Q70: A corporation's taxable income almost never is

Q87: If the amount of the insurance recovery

Q108: Only self-employed individuals are required to make

Q137: Which of the following is not a

Q141: Mary purchased a new five-year class asset

Q159: Purchased goodwill must be capitalized,but can be