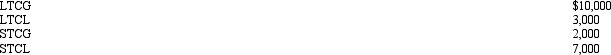

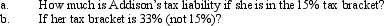

During 2013,Addison has the following gains and losses:

Definitions:

Activity-Based Costing

Activity-based costing is a method of assigning indirect costs to products and services based on the activities they require.

Predetermined Overhead Rate

A calculated rate used to allocate manufacturing overhead costs to products based on a certain activity base like labor hours or machine hours.

Traditional Costing

A costing method that allocates overhead based on a predetermined rate, often leading to less accuracy in product costing.

Direct Labor-Hours

The total number of working hours spent by employees directly involved in manufacturing goods, critical for computing production costs.

Q12: Revenue Procedures deal with the internal management

Q13: A taxpayer who uses the automatic mileage

Q18: In a U.S.District Court,a jury can decide

Q19: For gifts made after 1976,when will part

Q46: Mauve Company permits employees to occasionally use

Q47: Individuals with modified AGI of $100,000 can

Q70: In some foreign countries,the tax law specifically

Q82: Discuss the application of holding period rules

Q85: "Temporary differences" are book-tax differences that appear

Q192: Define an involuntary conversion.