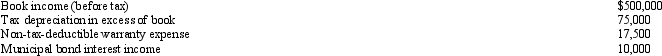

Wilde,Inc.,reported the following results for the current year.

Determine Wilde's taxable income for the current year.Identify any temporary or permanent book-tax differences.

Determine Wilde's taxable income for the current year.Identify any temporary or permanent book-tax differences.

Definitions:

RRSP

Registered Retirement Savings Plan, a retirement savings and investment vehicle for employees and the self-employed in Canada, offering tax benefits.

Twentieth Year

Referring to the twentieth year in a sequence or duration, often used in the context of anniversaries or timelines.

Annually

Occurring once every year or relating to a period of one year.

RRSP

Registered Retirement Savings Plan, a Canadian investment account designed to save for retirement, offering tax benefits.

Q33: Sylvia,age 17,is claimed by her parents as

Q44: Olive,Inc.,an accrual method taxpayer,is a corporation that

Q51: Kim dies owning a passive activity with

Q54: The special allocation opportunities that are available

Q56: The first codification of the tax law

Q59: Tonya owns an interest in an activity

Q70: Determination letters usually involve finalized transactions.

Q73: The cost of depreciable property is not

Q91: Ronaldo contributed stock worth $12,000 to the

Q117: Benjamin,age 16,is claimed as a dependent by