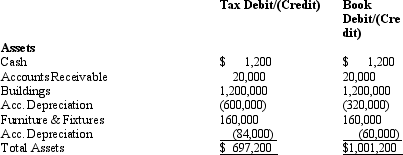

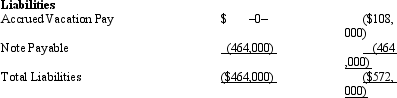

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

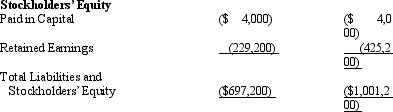

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

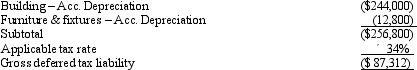

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Definitions:

Minority Influence

The process by which a smaller number of individuals affects the opinions or behaviors of the larger group.

Convergent Thinking

Convergent Thinking is a problem-solving process that involves combining different ideas and knowledge to determine a single, correct solution to a problem.

Task Conflict

Occurs when team members have disagreements about the content and outcomes of the task being performed, potentially leading to creative problem-solving or tension.

Process Conflict

Disagreements or disputes among team members about the logistics, delegation, and management of work tasks, often arising from differences in working styles or priorities.

Q62: Nontax factors that affect the choice of

Q65: In which,if any,of the following situations is

Q69: In January 2013,Tammy purchased a bond due

Q80: Under the right circumstances,a taxpayer's meals and

Q86: If an individual is subject to the

Q102: Jamie is terminally ill and does not

Q103: Last year,Amos had AGI of $50,000.Amos also

Q111: Cream,Inc.'s taxable income for 2013 before any

Q149: Residential rental real estate includes property where

Q167: Discuss the beneficial tax consequences of an