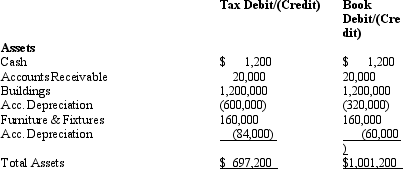

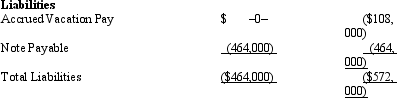

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

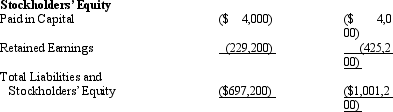

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

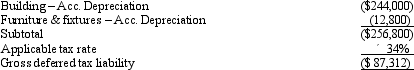

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the change in Amelia's deferred tax liabilities for the current year.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the change in Amelia's deferred tax liabilities for the current year.

Definitions:

Development Stage

Refers to a period or phase in an individual's life or in the evolution of a product or concept that represents a state of growth or progress.

Mowrer's Two-factor Theory

A psychological theory that explains learning and behavior as a combination of classical conditioning and operant conditioning.

Burrhus F. Skinner

A prominent American psychologist best known for his work in behaviorism and the development of the theory of operant conditioning.

Operant Conditioning

A learning process in which the strength of a behavior is modified by reinforcement or punishment, a key concept in behavioral psychology.

Q2: Bradley has two college-age children,Clint,a freshman at

Q22: Van Dyke,Inc.,hopes to report a total book

Q35: In November 2013,Katie incurs unreimbursed moving expenses

Q58: In January,Lance sold stock with a cost

Q63: An accrual basis taxpayer who owns and

Q92: Flora Company owed $95,000,a debt incurred to

Q115: Last year,Green Corporation incurred the following expenditures

Q118: For an activity classified as a hobby,the

Q141: Linda,who has AGI of $120,000 in 2013,contributes

Q165: Abner contributes $2,000 to the campaign of