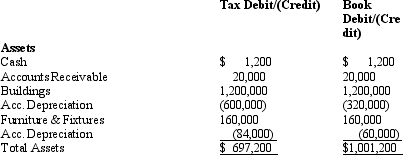

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Definitions:

Fixed Expenses

Fixed expenses are costs that do not change with the volume of output, such as rent or salaries, providing stability in financial planning but requiring effective budget management.

Net Income

The total profit of a company after deducting all expenses, taxes, and losses, indicating its financial performance over a period.

Total Expenses

The sum of all costs and expenses incurred by a business during a specific period, including operating expenses and cost of goods sold.

Direct Materials

Raw materials that can be directly linked to the production of specific goods or services.

Q1: A taxpayer must pay any tax deficiency

Q8: Arnold is married to Sybil,who abandoned him

Q36: Gain on the sale of collectibles held

Q56: The Blue Utilities Company paid Sue $2,000

Q63: Derek,age 46,is a surviving spouse.If he has

Q97: Josie,an unmarried taxpayer,has $155,000 in salary,$10,000 in

Q99: Ted was shopping for a new automobile.He

Q117: Pat sells a passive activity for $100,000

Q130: The accumulated earnings tax rate in 2013

Q133: An "above the line" deduction refers to