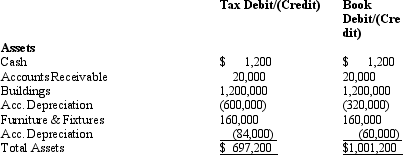

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Definitions:

Medially Located

Situated or positioned in the middle towards the midline of a body or structure.

Lateral Corticospinal Tract

A major pathway in the central nervous system involved in the control of voluntary motor movements, particularly those involving the limbs.

Anterior Corticospinal Tract

A descending spinal tract that originates in the cerebral cortex and carries motor signals to the spinal cord, involved in the direct control of movements especially of the limbs.

Tectospinal Tract

A neural pathway in the central nervous system that mediates reflex postural movements in response to visual stimuli.

Q17: Bruce,who is single,had the following items for

Q20: Georgia contributed $2,000 to a qualifying Health

Q37: Cold,Inc.,reported a $100,000 total tax expense for

Q56: The Blue Utilities Company paid Sue $2,000

Q61: Maroon Corporation expects the employees' income tax

Q82: Bunker,Inc.,is a domestic corporation.It owns 100% of

Q91: Rustin bought used 7-year class property on

Q108: James purchased a new business asset (three-year

Q125: Sonja is a United States citizen who

Q125: Of the corporate types of entities,all are