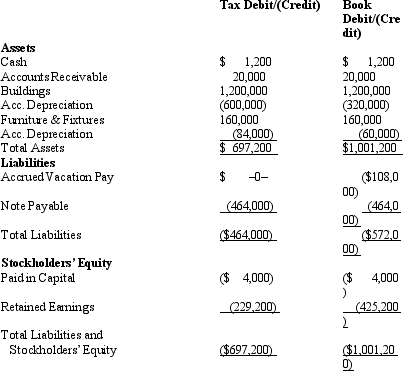

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

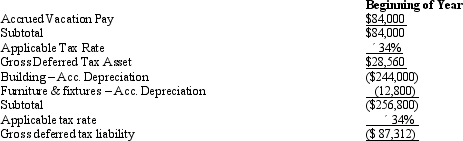

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Provide the income tax footnote rate reconciliation for Amelia.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Provide the income tax footnote rate reconciliation for Amelia.

Definitions:

Sense The Presence

The feeling or perception that someone or something is in a certain place without any direct sensory evidence.

Instinctive Behavior

Actions or reactions that an organism is genetically predisposed to perform without the necessity of learning or experience.

Entire Species

A group comprising all individuals capable of interbreeding and producing fertile offspring, typically sharing common characteristics and genetically distinct from other groups.

Unlearned

Referring to behaviors or responses that are innate or natural, not acquired or learned through experience or socialization.

Q7: Judy is a cash basis attorney.In 2013,she

Q42: Nelda is married to Chad,who abandoned her

Q45: The Dargers have itemized deductions that exceed

Q78: The annual increase in the cash surrender

Q109: Ethan,a bachelor with no immediate family,uses the

Q110: In determining whether a debt is a

Q116: Pablo,who is single,has $95,000 of salary,$10,000 of

Q129: On March 1,2013,Lana leases and places in

Q138: Under the Federal income tax formula for

Q148: Once the actual cost method is used,a