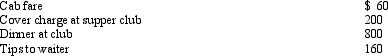

Robert entertains several of his key clients on January 1 of the current year.Expenses paid by Robert are as follows:  Presuming proper substantiation,Robert's deduction is:

Presuming proper substantiation,Robert's deduction is:

Definitions:

Truck A/C System

The air conditioning system in a truck, designed to cool the interior of the vehicle to enhance occupant comfort.

Adding Oil

The process of introducing more oil to a system or component to ensure proper lubrication and functionality.

R-134a System

A cooling system that utilizes R-134a refrigerant, commonly found in automotive air conditioning systems, known for its environmental benefits over older refrigerants.

Q6: Stealth taxes are directed at lower income

Q28: In early 2013,Ben sold a yacht,held for

Q50: Augie purchased one new asset during the

Q56: Will all AMT adjustments reverse? That is,do

Q58: Repatriating prior year earnings from a foreign

Q59: A CFO probably prefers a tax planning

Q60: Walter wants to sell his wholly-owned C

Q78: Kay had percentage depletion of $119,000 for

Q88: For purposes of computing the credit for

Q95: The taxpayer's marginal tax bracket is 25%.Which