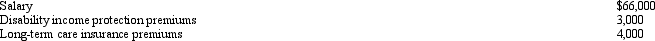

James,a cash basis taxpayer,received the following compensation and fringe benefits in 2013:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

Definitions:

Legally Married

A state of being in a marriage that is recognized and sanctioned by law, involving a formal agreement entered into by two individuals that is legally binding.

Family Violence

A pattern of abusive behaviors in family relationships, including physical, sexual, psychological abuse, or neglect.

Fiscal Restraint

Economic policies aimed at reducing government deficits and debt accumulation by means of spending cuts, tax increases, or a mix of both.

Canadian Hospitals

Healthcare institutions in Canada that provide clinical treatment with specialized staff and equipment, often funded publicly within the Canadian healthcare system.

Q4: Since most tax preferences are merely timing

Q6: The tax concept and economic concept of

Q8: Doug and Pattie received the following interest

Q20: Compare Revenue Rulings with Revenue Procedures.

Q23: Clara,age 68,claims head of household filing status.If

Q43: Which item may not be cited as

Q56: The Blue Utilities Company paid Sue $2,000

Q64: S corporation status always avoids double taxation.

Q66: An advance payment received in June 2013

Q90: Ralph purchased his first Series EE bond