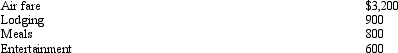

During the year,John went from Milwaukee to Alaska on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

Definitions:

Withdrawal

The act of reducing or eliminating the use of a substance after prolonged or excessive use, often leading to uncomfortable physical or psychological symptoms.

Dependence

a state in which an organism requires a substance to function normally, which can lead to physical or psychological addiction.

Conscious Experience

The subjective awareness of one's thoughts, feelings, and perceptions in the present moment.

Early-20th-century Psychologists

Psychologists from the period of the 1900s to 1920, who contributed foundational theories and research methodologies to the field of psychology.

Q6: Arizona is in the jurisdiction of the

Q9: A negative ACE adjustment is beneficial to

Q44: Because current U.S.corporate income tax rates are

Q55: Melinda's basis for her partnership interest is

Q75: Explain the purpose of the tax credit

Q76: In the case of a zero interest

Q83: Robin Company has $100,000 of income before

Q113: Child and dependent care expenses include amounts

Q115: The exclusion of interest on educational savings

Q147: A taxpayer who maintains an office in