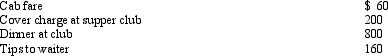

Robert entertains several of his key clients on January 1 of the current year.Expenses paid by Robert are as follows:  Presuming proper substantiation,Robert's deduction is:

Presuming proper substantiation,Robert's deduction is:

Definitions:

Storyboard

An easy form of prototyping that provides a high-level view of thoughts and ideas arranged in sequence in the form of drawings, sketches, or illustrations.

Lengthy, Detailed Document

A document that provides an extensive and comprehensive detail on a specific topic, often used for planning, reporting, or research purposes.

Reaction

The response or change in behavior that occurs as a result of an external stimulus.

Controlled Experiment

A scientific research method where one variable is changed at a time to isolate the effects of that variable on the outcome.

Q8: Arnold is married to Sybil,who abandoned him

Q9: Kirk is establishing a business in 2013

Q14: Keosha acquires 10-year personal property to use

Q46: Several years ago,Tom purchased a structure for

Q86: Sarah furnishes more than 50% of the

Q89: Under what circumstances are corporations exempt from

Q96: If a taxpayer does not own a

Q99: In terms of income tax consequences,abandoned spouses

Q110: ForCo,a non-U.S.corporation based in Aldonza,purchases widgets from

Q129: The corporation has a greater potential for