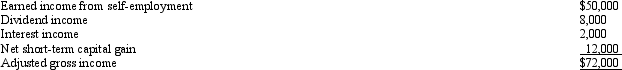

Susan is a self-employed accountant with a qualified defined contribution plan (a Keogh plan) .She has the following income items for the year:  What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2013,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Susan can deduct as a contribution to her retirement plan in 2013,assuming the self-employment tax rate is 15.3%?

Definitions:

Additional Investment

Funds injected into a business by its owners or shareholders over and above the initial investment, typically to support operations, expansion, or growth.

Revenue Recognition

An accounting principle that outlines the specific conditions under which revenue is recognized and dictates how it should be reported in the accounts.

Production Process

The sequence of operations or procedures used to create finished goods from raw materials, typically involving planning, sourcing, manufacturing, and quality control.

Services Rendered

Work or duties provided by one party to another, often resulting in payment for the work done.

Q8: Tax bills are handled by which committee

Q35: For a C corporation to be classified

Q36: Agnes receives a $5,000 scholarship which covers

Q38: The purpose of the transfer pricing rules

Q52: Mel was the beneficiary of a $45,000

Q63: Janet,who lives and works in Newark,travels to

Q64: Cardinal Corporation hires two persons certified to

Q76: C corporations and their shareholders are subject

Q102: Under the original issue discount (OID)rules as

Q146: During the year,Walt travels from Seattle to