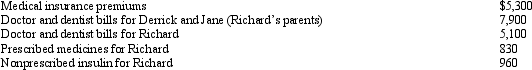

Richard,age 50,is employed as an actuary.For calendar year 2013,he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2013 and received the reimbursement in January 2014.What is Richard's maximum allowable medical expense deduction for 2013?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2013 and received the reimbursement in January 2014.What is Richard's maximum allowable medical expense deduction for 2013?

Definitions:

Anterior Spinothalamic Tract

The anterior spinothalamic tract is a sensory pathway of the spinal cord that carries information about light touch and pressure to the brain.

Tertiary Neurons

Neurons that receive signals from secondary neurons and typically transmit them to the brain or spinal cord for integration.

Extrapyramidal Tracts

A network of neurons not part of the pyramidal system, involved in the control of involuntary motor movements.

Taste Area

A region in the brain, specifically within the gustatory cortex, responsible for processing taste information.

Q1: Summer Corporation's business is international in

Q5: The legal form of Edith and Fran's

Q11: Bob lives and works in Newark,NJ.He travels

Q17: Which of the following is not relevant

Q31: Black Company paid wages of $180,000,of which

Q45: The calculation of FICA and the self-employment

Q58: Jaime received gross foreign-source dividend income of

Q62: Most states begin the computation of corporate

Q104: The "residence of seller" rule is used

Q142: Lily went from her office in Portland