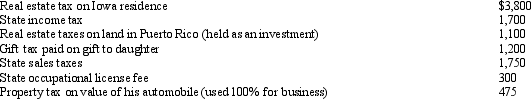

During 2013,Hugh,a self-employed individual,paid the following amounts:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

Definitions:

Negligent

Failing to take appropriate care in doing something, which results in damage or harm to another party.

Anticipated Injury

Anticipated injury refers to harm or damage that is expected or foreseen as a result of certain actions or omissions.

Good Samaritan Law

Good Samaritan Laws are legal protections designed to encourage people to offer assistance to others in distress by granting them immunity from certain forms of legal liability.

Independent Contractor

An individual or business that provides goods or services to another entity under terms specified in a contract, distinct from an employee due to the contractor’s control over their work.

Q19: An S corporation cannot be a shareholder

Q25: Which items tell taxpayers the IRS's reaction

Q36: Dividends received from a domestic corporation are

Q39: Kirby is in the 15% tax bracket

Q40: The Golsen rule has been overturned by

Q72: Jena is a full-time undergraduate student at

Q113: A unitary business applies a combined apportionment

Q119: Butch and Minerva are divorced in December

Q138: Eagle,Inc.recognizes that it may have an accumulated

Q151: Meg's employer carries insurance on its employees