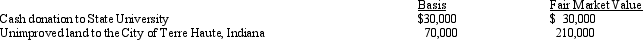

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in 2013:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

Definitions:

Stipulative Definitions

Definitions that assign a meaning to a word for the first time, without regard for any previous meanings.

Logical Definition

A precise explanation of a term or concept based on its essential attributes and its distinction from related terms.

Genus

A major classification category situated above species and beneath family, employed in the categorization of both living and extinct life forms.

Circularity

A reasoning error where the conclusion is included in the premises or assumed in one of the premises.

Q6: Amy lives and works in St.Louis.In the

Q34: A "U.S.shareholder" for purposes of CFC classification

Q44: If an activity involves horses,a profit in

Q73: In the "rate reconciliation" of GAAP tax

Q74: Lucas,age 17 and single,earns $6,000 during 2013.Lucas's

Q78: Mercedes owns a 30% interest in Magenta

Q82: Monique is a resident of the U.S.and

Q88: Any distribution made by an S corporation

Q107: When filing their Federal income tax returns,the

Q110: Paul and Patty Black (both are age