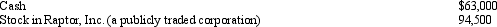

During 2013,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2013 is $189,000.What is Ralph's charitable contribution deduction for 2013?

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2013 is $189,000.What is Ralph's charitable contribution deduction for 2013?

Definitions:

Black Americans

Refers to American citizens or residents of African descent, often with a history tied to slavery and civil rights struggles in the United States.

NAACP

The National Association for the Advancement of Colored People, a civil rights organization founded in 1909 to fight for justice for African Americans.

Magazine

A publication, usually periodic, that contains articles, stories, photographs, and advertisements, often targeting a specific audience or interest group.

Guinn V. United States

A landmark Supreme Court case in 1915 that declared certain grandfather clause exemptions to literacy tests for voting rights unconstitutional, impacting African American voters.

Q30: The basic and additional standard deductions both

Q35: For a C corporation to be classified

Q40: The Golsen rule has been overturned by

Q43: Tanver Corporation,a calendar year corporation,has alternative minimum

Q63: Chipper,Inc.,a U.S.corporation,reports worldwide taxable income of $1

Q78: What are the relevant factors to be

Q93: Which of the following is a principle

Q96: If a taxpayer does not own a

Q100: U.S.income tax treaties typically:<br>A)Provide for taxation exclusively

Q145: Adam repairs power lines for the Egret