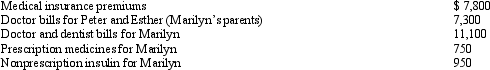

Marilyn,age 38,is employed as an architect.For calendar year 2013,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2013 and received the reimbursement in January 2014.What is Marilyn's maximum allowable medical expense deduction for 2013?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2013 and received the reimbursement in January 2014.What is Marilyn's maximum allowable medical expense deduction for 2013?

Definitions:

Moral Principles

Fundamental beliefs about what is right, wrong, or acceptable in behavior or decision-making.

Ethics

A branch of philosophy dealing with values relating to human conduct, with respect to the rightness and wrongness of certain actions.

Laws

Society’s values and standards that are enforceable in the courts.

Enforceable

Describes legal agreements or rules that are valid and can be implemented or compelled by law.

Q25: An individual,age 40,who is not subject to

Q32: Most IRAs cannot own stock in an

Q42: Under P.L.86-272,the taxpayer is exempt from state

Q42: In March 2013,Gray Corporation hired two individuals,both

Q45: The Dargers have itemized deductions that exceed

Q53: After personal property is fully depreciated for

Q70: In some foreign countries,the tax law specifically

Q74: The § 222 deduction for tuition and

Q130: Once a child reaches age 19,the kiddie

Q135: Which of the following correctly reflects current