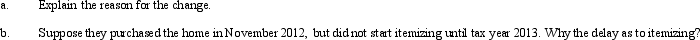

When filing their Federal income tax returns,the Youngs always claimed the standard deduction.After they purchased a home,however,they started to itemize their deductions from AGI.

Definitions:

Service Learning

Programs that give students the opportunity to take leadership in identifying community problems and implement service projects to meet these needs while also embedding academic activities in the projects.

Community Needs

Refer to the essential services, resources, and support required by a community to ensure the well-being and development of its members.

Initiatives

Projects or strategies introduced to address specific issues or achieve particular outcomes.

Fair

Fair, in a general sense, refers to being free from bias, dishonesty, or injustice, typically in the context of treatment of individuals or distribution of resources.

Q3: Which company does not publish citators for

Q25: How can an AMT adjustment be avoided

Q54: After the divorce,Jeff was required to pay

Q55: Arnold is employed as an assistant manager

Q63: Frederick sells land and building whose adjusted

Q74: Tax-exempt income at the S corporation level

Q106: Anne contributes property to the TCA Partnership

Q118: Tax-exempt income at the corporate level flows

Q127: In 2012,Juan and Juanita incur $9,800 in

Q132: Ashley earns a salary of $55,000,has capital