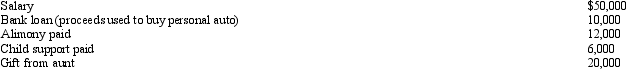

During 2013,Marvin had the following transactions:  Marvin's AGI is:

Marvin's AGI is:

Definitions:

Systematic Risk Principle

The concept that an investor can reduce the overall risk of an investment portfolio through diversification, except for inherent market risks that cannot be diversified away.

Efficient Markets Hypothesis

The efficient markets hypothesis is an investment theory that states it is impossible to "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information.

Security Market Line

A representation in finance that shows the relationship between risk and return of a market.

Beta Coefficient

A measure of a stock's volatility in relation to the overall market, indicating its level of risk compared to the market average.

Q9: Fred and Lucy are married,ages 33 and

Q15: The sourcing rules of Federal income taxation

Q22: Unless circulation expenditures are amortized over a

Q39: Adjusted gross income (AGI)sets the ceiling or

Q70: In its first year of operations,a corporation

Q88: A number of court cases in the

Q94: Kyle and Liza are married and under

Q114: Included among the factors that influence the

Q123: An employee can exclude from gross income

Q136: Excess charitable contributions that come under the