Multiple Choice

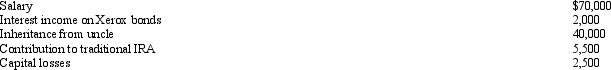

During 2013,Esther had the following transactions:  Esther's AGI is:

Esther's AGI is:

Definitions:

Invoice Price

The price of a product or service indicated on the invoice, representing the amount the buyer should pay.

Related Questions

Q2: Amber is in the process this year

Q9: For purposes of determining gross income,which of

Q27: A corporation may alternate between S corporation

Q31: During the current year,Doris received a large

Q38: Generally,a U.S.citizen is required to include in

Q50: An S shareholder who dies during the

Q88: Low- and middle-income taxpayers may make nondeductible

Q109: Arnold purchases a building for $750,000 which

Q114: Included among the factors that influence the

Q115: In connection with the office in the