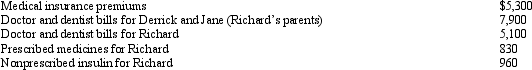

Richard,age 50,is employed as an actuary.For calendar year 2013,he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2013 and received the reimbursement in January 2014.What is Richard's maximum allowable medical expense deduction for 2013?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2013 and received the reimbursement in January 2014.What is Richard's maximum allowable medical expense deduction for 2013?

Definitions:

Elisabeth Kübler-Ross

A psychiatrist known for her theory on the five stages of grief: denial, anger, bargaining, depression, and acceptance.

Laboratory Results

Data and findings derived from scientific experiments conducted in controlled environments for the purpose of research and diagnosis.

Abraham Maslow

An American psychologist known for creating Maslow's hierarchy of needs, a theory of psychological health predicated on fulfilling innate human needs.

Dying Process

The final stage of life characterized by the gradual cessation of bodily functions leading to death.

Q23: Which of the following statements regarding a

Q42: Distinguish between the jurisdiction of the U.S.Tax

Q46: Several years ago,Tom purchased a structure for

Q53: Which of the following statements regarding the

Q55: A taxpayer must pay any tax deficiency

Q76: For tax purposes,"travel" is a broader classification

Q81: Gold Company was experiencing financial difficulties,but was

Q83: Morrisson,Inc.,earns book net income before tax of

Q83: Chipper Corporation realized $1,000,000 taxable income

Q120: After a § 721 contribution by a