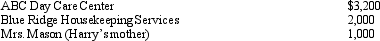

Harry and Wilma are married and file a joint income tax return.On their tax return,they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wilma) and claim two exemptions for their dependent children.During the year,they pay the following amounts to care for their 16-year old son and 6-year old daughter while they work.  Harry and Wilma may claim a credit for child and dependent care expenses of:

Harry and Wilma may claim a credit for child and dependent care expenses of:

Definitions:

Duty Of Care

A legal obligation requiring individuals to exercise a standard of reasonable care while performing acts that could foreseeably harm others.

Unforeseeable Risks

Risks that cannot reasonably be anticipated or predicted, often affecting contracts or liability.

Reasonable Person Standard

A measurement of the way members of society expect an individual to act in a given situation.

Privilege

A special right, advantage, or immunity granted or available only to a particular person or group.

Q11: Bob lives and works in Newark,NJ.He travels

Q21: Any distribution of cash or property by

Q36: Aaron is a self-employed practical nurse who

Q44: The termination of an S election occurs

Q47: An S shareholder's stock basis does not

Q66: Corey is the city sales manager for

Q74: If the IRS reclassifies debt as equity

Q89: Pass-through S corporation losses can reduce the

Q101: Which of the following is not a

Q115: Under what circumstances,if any,do the § 469