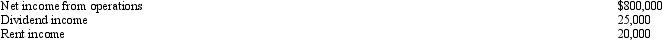

Catfish,Inc.,a closely held corporation which is not a PSC,owns a 45% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year,Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Standard Cost Accounting System

A cost accounting system that assigns preset costs to products or services, used for budgeting and controlling expenses.

Ideal Standards

Benchmark levels of performance set under perfect operating conditions, used for budgeting and measuring efficiency.

Materials Price Variance

The difference between the actual cost of materials and the standard or expected cost.

Standard Costs

Predetermined costing used in budgeting and decision-making, representing an expected cost under normal conditions.

Q6: Which of the following statements regarding income

Q13: Green Company,in the renovation of its building,incurs

Q20: In May 2013,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q52: The IRS is not required to make

Q63: S corporation status allows shareholders to realize

Q66: Discuss the treatment of unused general business

Q81: After she finishes working at her main

Q95: A domestic corporation is one whose assets

Q119: Butch and Minerva are divorced in December

Q131: The kiddie tax does not apply to