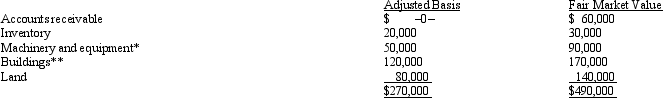

Mr.and Ms.Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Total Output

The total amount of goods and services produced by an economy or a firm within a specific period.

Productive Capacity

The maximum output a company, sector, or economy can produce using its current resources efficiently.

Wage Bill

The total amount of money paid by businesses to their employees for work performed, typically over a specific period.

Remittance

The transfer of money by foreign workers to individuals in their home country.

Q9: An S corporation is subject to the

Q17: Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates

Q48: Liam just graduated from college.Because it is

Q62: Interest paid or accrued during the tax

Q72: An S corporation is not subject to

Q101: Lemon,Inc.,has the following items related to

Q113: Child and dependent care expenses include amounts

Q115: Under what circumstances,if any,do the § 469

Q157: Assuming a taxpayer qualifies for the exclusion

Q159: On their birthdays,Lily sends gift certificates (each