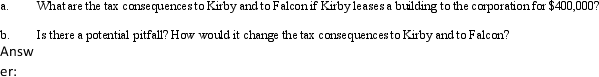

Kirby,the sole shareholder of Falcon,Inc.,leases a building to the corporation.The taxable income of the corporation for 2013,before deducting the lease payments,is projected to be $500,000.

Definitions:

Middle-Aged Adults

Individuals who are typically between the ages of approximately 40 and 65, often experiencing transitions in physical health, occupations, and family dynamics.

Midlife Crisis

A period of emotional turmoil in middle age characterized by a desire for change, often sparked by a recognition of one's mortality and unfulfilled aspirations.

Levinson

A psychologist known for his theory on adult development, outlining stages and transitions across the lifespan, including early adult transition and mid-life crisis.

Age-Denying Behaviors

Actions undertaken to resist or minimize the appearance or effects of aging.

Q38: Generally,a U.S.citizen is required to include in

Q44: The AMT statutory rate for C corporations

Q50: Allison is a 40% partner in the

Q56: Which of the following is not a

Q69: In determining the filing requirement based on

Q75: Qwan,a U.S.corporation,reports $250,000 interest expense for

Q108: If an individual contributes an appreciated personal

Q116: One indicia of independent contractor (rather than

Q137: Early in the year,Marion was in an

Q175: Pedro is married to Consuela,who lives with