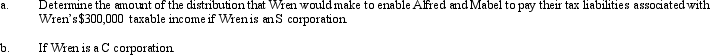

Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 35%.Wren's taxable income for 2013 is $300,000.

Definitions:

Biological Aspect

Pertaining to the physiological and genetic factors that influence an organism’s behavior, structure, and function.

Family Context

The environmental and relational factors within a family that influence and shape individuals' behaviors and developmental outcomes.

Marital Status

is a legal or social category that indicates whether an individual is unmarried, married, divorced, widowed, or in a partnership.

Chronological Age

The exact age of an individual, measured in years, months, and days, from the date of birth.

Q18: The U.S.system for taxing income earned inside

Q32: Typically,corporate income taxes constitute about 20 percent

Q57: Cardinal Company incurs $800,000 during the year

Q81: Candace,who is in the 33% tax bracket,is

Q81: In 2013,Ed is 66 and single.If he

Q91: The disabled access credit is computed at

Q105: Evan is a contractor who constructs both

Q115: The exclusion of interest on educational savings

Q121: An S shareholder's stock basis is reduced

Q126: When loss assets are distributed by an