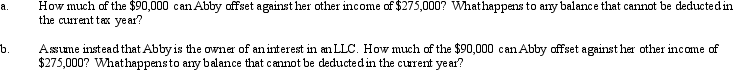

Abby is a limited partner in a limited partnership.Her basis in the partnership interest is $80,000 with an at-risk basis of $75,000.Abby's share of the partnership loss for the tax year is $90,000.She has other income of $275,000.

Definitions:

Amplitude

In physics, amplitude refers to the maximum extent of a vibration or oscillation, measured from the position of equilibrium.

Accommodation

(1) In developmental psychology, adapting our current understandings (schemas) to incorporate new information. (2) In sensation and perception, the process by which the eye’s lens changes shape to focus near or far objects on the retina.

Adjustable Opening

A feature or mechanism that allows the size of an opening to be modified or adjusted as needed.

Accommodation of the Lens

The process by which the eye's lens changes shape to focus near or far objects on the retina.

Q14: The election to itemize is appropriate when

Q30: Krebs,Inc.,a U.S.corporation,operates an unincorporated branch manufacturing operation

Q43: A worker may prefer to be classified

Q47: ABC LLC reported the following items on

Q96: If a taxpayer does not own a

Q102: The work opportunity tax credit is available

Q109: An assembly worker earns a $50,000 salary

Q112: Abby is a limited partner in a

Q115: Given the following information,determine if FanCo,a

Q118: For an activity classified as a hobby,the