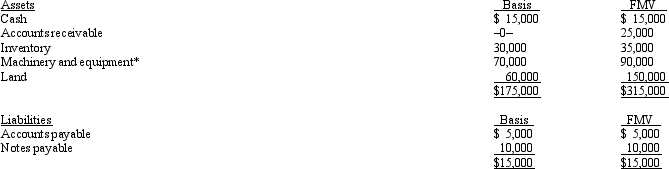

Ralph owns all the stock of Silver,Inc.,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

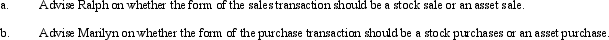

Ralph has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Definitions:

Holding-Period Return

The return on an investment over the period it is held, incorporating both income and capital gains.

Dividend

A distribution of profits by a corporation to its shareholders, often in the form of a payment.

Expected Standard Deviation

A statistical measure that quantifies the amount of variation or dispersion of a set of expected values, often used to quantify the risk associated with a particular asset or investment.

Probability Distribution

A mathematical function that describes the likelihood of obtaining the possible values that a random variable can assume.

Q1: Which,if any,of the following can be eligible

Q12: During the year,Green Corporation (a U.S.corporation)has U.S.-source

Q20: Georgia contributed $2,000 to a qualifying Health

Q21: If a partnership allocates losses to the

Q26: Vicki owns and operates a news agency

Q28: On a partnership's Form 1065,which of the

Q28: A distribution from OAA is taxable.

Q42: Distinguish between the jurisdiction of the U.S.Tax

Q48: Liam just graduated from college.Because it is

Q126: AirCo,a domestic corporation,purchases inventory for resale from