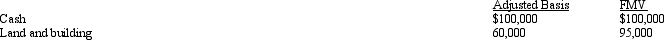

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

a. Sole proprietorship?

b. General partnerslrip?

c. Limited partnership?

d. C corporation?

e. S corporation?

Definitions:

Yield To Maturity

The total return anticipated on a bond if held until it matures, including all interest payments and the repayment of principal.

Bond's Value

The present worth of a bond's future interest payments and its repayment of principal at maturity, adjusted for current market interest rates.

9-Year Duration

A metric indicating the sensitivity of a bond's price to changes in interest rates, represented here as the bond having an average response over a nine-year period.

Default Risks

The likelihood that a borrower will fail to meet the obligations of paying back a loan or interest payments.

Q11: Beige,Inc.,has 3,000 shares of stock authorized and

Q20: Compare Revenue Rulings with Revenue Procedures.

Q20: Joyce,age 40,and Sam,age 42,who have been married

Q22: All of the U.S.states use an apportionment

Q37: Durell owns a construction company that builds

Q38: For tax purposes,married persons filing separate returns

Q51: What are Treasury Department Regulations?

Q80: All of a C corporation's AMT is

Q125: Of the corporate types of entities,all are

Q138: Tired of renting,Dr.Smith buys the academic robes