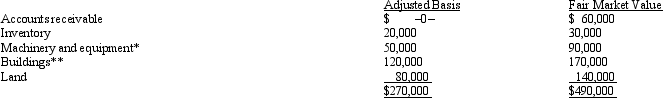

Mr.and Ms.Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Authentic Leadership

A style of leadership that emphasizes the genuineness and integrity of the leader, fostering trust and open communication.

Transformational Leadership

A leadership style that inspires and motivates followers to exceed expectations and facilitate change through vision, stimulation, and individual consideration.

Providing Direction

The act of guiding or leading others by setting goals, giving instructions, and offering feedback to achieve desired outcomes or objectives.

Savvy

Possessing practical knowledge or understanding, often in a specific field or situation.

Q7: A benefit of an S corporation when

Q8: Arnold is married to Sybil,who abandoned him

Q10: Milt Corporation owns and operates two

Q12: Amy works as an auditor for a

Q13: A taxpayer who uses the automatic mileage

Q20: Joyce,age 40,and Sam,age 42,who have been married

Q22: A taxpayer may not appeal a case

Q43: Items that are not required to be

Q103: If an S corporation distributes appreciated property

Q129: Which of the following statements regarding the