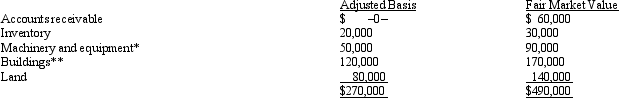

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Authentication

The process of verifying the identity of a user or system, often through passwords, biometrics, or cryptographic keys.

Data Mining

The process of analyzing large sets of data to discover patterns, trends, and information useful for decision-making and prediction.

Browser Security Settings

Configuration options in a web browser that manage security aspects such as cookie handling, data sharing, and protection against malicious websites.

Online Retailers

Businesses that sell goods or services over the internet directly to consumers.

Q9: A negative ACE adjustment is beneficial to

Q35: C corporations are subject to a positive

Q43: Stock basis first is increased by income

Q52: The IRS is not required to make

Q64: Cardinal Corporation hires two persons certified to

Q69: Regarding tax favored retirement plans for employees

Q72: Jena is a full-time undergraduate student at

Q83: During 2013,Ralph made the following contributions to

Q99: U.S.individuals who receive dividends from foreign corporations

Q110: A distribution of cash or other property