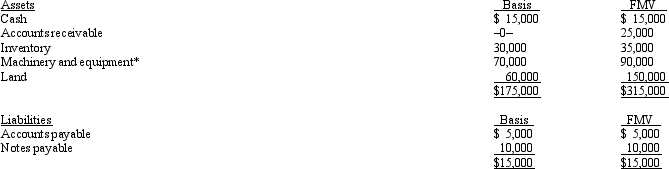

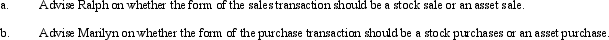

Ralph owns all the stock of Silver,Inc.,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Definitions:

Hormone

A chemical substance produced in the body that serves as a messenger, regulating and coordinating various physiological activities.

Consciousness

The quality or state of being aware of an external object or something within oneself.

Personal Awareness

The conscious understanding and recognition of one’s own personality, feelings, motives, and desires.

Sensations

The process by which our sensory receptors and nervous system receive and represent stimulus energies from our environment.

Q11: Beige,Inc.,has 3,000 shares of stock authorized and

Q35: Which of the following statements best describes

Q50: Factors that should be considered in making

Q62: Interest paid or accrued during the tax

Q81: Steve has a tentative general business credit

Q96: Herbert is the sole proprietor of a

Q101: Which of the following is not a

Q106: It is not beneficial for an S

Q125: Post-termination distributions that are charged against OAA

Q168: In 2013,Jerry pays $8,000 to become a