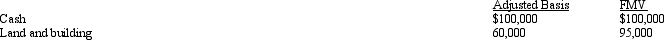

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

a. Sole proprietorship?

b. General partnerslrip?

c. Limited partnership?

d. C corporation?

e. S corporation?

Definitions:

Product Quality

The measure of a product's performance, durability, reliability, and compliance with standards that meet or exceed customer expectations.

Feedback-Based Quality

An approach to quality improvement that relies on using customer or user feedback to inform changes and enhancements.

Transcendent Quality

A level of quality that goes beyond ordinary limits, often difficult to quantify but recognized through experience.

Crisis Management

The process by which an organization deals with a disruptive and unexpected event that threatens to harm the organization or its stakeholders.

Q1: Which,if any,of the following can be eligible

Q15: Nicole's employer pays her $150 per month

Q17: Which of the following is not relevant

Q25: How can an AMT adjustment be avoided

Q32: Jacob and Emily were co-owners of a

Q49: Discuss the advantages and disadvantages of the

Q54: The special allocation opportunities that are available

Q93: In January 2013,Tammy acquired an office building

Q112: Explain the OAA concept.

Q154: The education tax credits (i.e.,the American Opportunity