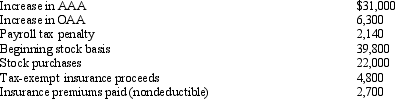

You are given the following facts about a solely owned S corporation.What is the shareholder's ending stock basis?

Definitions:

Plant Species

A distinct biological classification of plants, defined by particular characteristics that differentiate it from other species.

Animal Species

Distinct groups within the Animalia kingdom that share common characteristics and genetics, capable of breeding and producing fertile offspring.

National Parks

Protected areas established by governments around the world to preserve natural and cultural resources for education, recreation, and conservation purposes.

Biosphere Reserves

Areas of terrestrial and coastal ecosystems promoting solutions to reconcile the conservation of biodiversity with its sustainable use.

Q11: Eagle Company,a partnership,had a short-term capital loss

Q17: The purpose of the work opportunity tax

Q61: Which of the following statements is always

Q63: An examination of the RB Partnership's tax

Q73: Palmer contributes property with a fair market

Q74: An example of the "aggregate concept" underlying

Q76: Ryan is a 25% partner in the

Q76: Bob and Sally are married,file a joint

Q81: Performance,Inc.,a U.S.corporation,owns 100% of Krumb,Ltd.,a foreign corporation.Krumb

Q89: Pass-through S corporation losses can reduce the