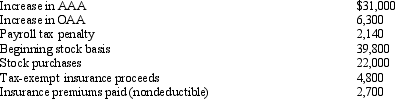

You are given the following facts about a solely owned S corporation.What is the shareholder's ending stock basis?

Definitions:

Emotion Management

The ability to recognize, manage, and control one's emotions and to understand and influence the emotions of others.

Emotion Management

The practice of overseeing and regulating one's emotions in various social contexts to adhere to societal norms.

Emotion Labour

The process of managing and sometimes suppressing personal feelings to fulfill the emotional requirements of a job, especially in service-oriented professions.

Manage Emotion

The process of recognizing, understanding, and properly expressing one's emotions in order to achieve emotional balance and well-being.

Q8: Only 51% of the shareholders must consent

Q12: No E & P adjustment is required

Q15: Freud studied hysteria, while Zeigarnik studied<br>A) delays

Q24: Among sociobiologists, the Leash Principle means<br>A) a

Q36: The tax treatment of corporate distributions at

Q37: Cattell believed that temperament traits<br>A) are genetically

Q46: Several years ago,Tom purchased a structure for

Q70: Use of MACRS cost recovery when computing

Q72: Tern Corporation,a cash basis taxpayer,has taxable income

Q80: With respect to income generated by non-U.S.persons,does