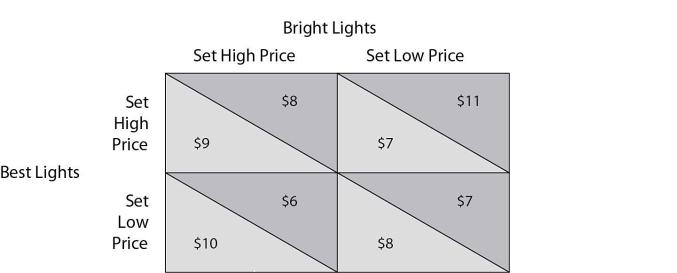

-Refer to the payoff matrix above. Which of the following is the Nash Equilibrium?

Definitions:

Portfolio's Expected Rate

The anticipated rate of return on a portfolio, based on the portfolio's asset allocation, expected performance, and market conditions.

Standard Deviation

A measure of the amount of variation or dispersion of a set of values, often used in statistics to quantify the volatility of a financial instrument.

Probability Distribution

An analytic function detailing the entire set of potential outcomes and their probabilities for a random variable within a certain range.

Global Minimum Variance Portfolio

An investment portfolio constructed to achieve the lowest possible risk (variance), given a set of securities.

Q2: For a dominant firm, the residual demand

Q12: Refer to the payoff matrix above. If

Q22: Underwater weighing to measure percentage of body

Q41: Identify three ways to incorporate physical activity

Q67: If Cruise the World advertises a 30

Q68: The competitive fringe firms in the market,

Q74: In a Cournot oligopoly, managers determine quantity

Q91: In the short run, a decrease in

Q95: If Happy Feet chooses to No Ad

Q114: If a perfectly competitive firm is producing