Happy Nails is a locally owned nail salon that is in its first year of business. The nail salon employs 8 nail technicians that are

Happy Nails is a locally owned nail salon that is in its first year of business. The nail salon employs 8 nail technicians that are

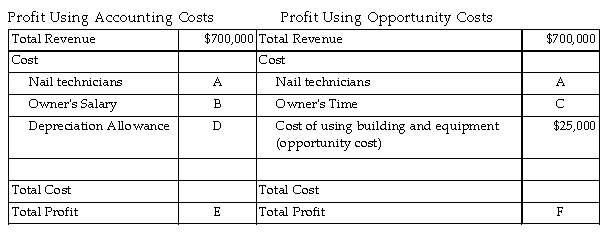

$31,250 each and the owner's is paid $75,000. If the owner did not own Happy Nails, she would work for a competitor for $85 the beginning of the year, the building and the salon equipment are worth $100,000 and at the end of the year, they are worth The accountant for Happy Nails uses straight- line depreciation for the 15- year life of the building and salon equipment. The table above provides some additional information on revenue and the opportunity cost of using the building and equipment.

-Refer to the table above. What is the value of A?

Definitions:

Cash Dividend

A payment made in cash to shareholders that is derived from a company's profits or reserves.

Times Interest Earned Ratio

A financial metric assessing a company’s ability to meet its interest obligations from its operating income.

Income Tax Payments

Income tax payments are the amounts of money a company or individual must pay to the government, based on the income earned over a tax period.

Interest Expense

The cost incurred by an entity for borrowed funds, reflecting the interest payments on debts.

Q16: The contradiction of scientific research in which

Q21: Which of the following statements BEST exemplifies

Q33: The manager of Slick Lens, a sunglasses

Q39: A misuse of authority occurs when experts

Q42: Conceptualization is the development of research procedures

Q53: The price elasticity of demand for Rosie's

Q65: Refer to the table above. What is

Q117: Refer to the table above. If Fresh

Q126: Happy Cows is a dairy farm that

Q154: Refer to the table above. If Sweet