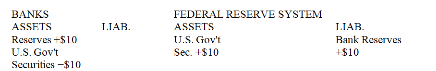

Table 13-1

EFFECTS OF AN OPEN MARKET TRANSACTION ON THE BALANCE SHEETS OF BANKS AND THE FED (In millions of dollars)

-After the transaction in Table 13-1 is completed, what happens to actual reserves, required reserves, and excess reserves?

Assume the required reserve ratio is 25 percent.

Definitions:

Common Stock

Equity securities representing ownership in a company, entitling holders to vote on corporate matters and receive dividends.

Deferred Tax Liability

A tax obligation that a company owes in the future due to temporary differences between its financial accounting and tax accounting practices.

Indirect Method

A method used in cash flow statements to adjust net income for non-cash transactions and changes in working capital to calculate cash flow from operating activities.

Indirect Method

A way of preparing the cash flow statement where net income is adjusted for changes in balance sheet accounts to calculate cash flow from operating activities.

Q8: Which of the following is not a

Q45: What will happen to the demand for

Q61: How does an increase in taxes affect

Q64: If interest rates increase,what will happen to

Q65: Money is an imperfect store of value

Q85: Any reserves held by a bank above

Q89: Government spending influences spending indirectly.

Q99: Critics of supply-side economics argue that a

Q136: The Troubled Asset Relief Program (TARP)totaled _

Q141: When will the difference between the actual