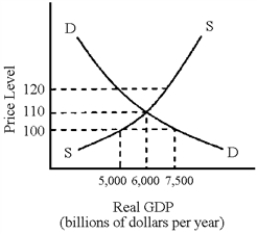

Figure 10-1

-If the price level in Figure 10-1 were 110,

Definitions:

Net Present Value

The difference between the present value of cash inflows and outflows over a period of time, used in capital budgeting to assess the profitability of an investment.

Present Value Index

A financial metric that evaluates the profitability of an investment or project by comparing the present value of cash inflows to the present value of cash outflows.

Compound Interest

This concept involves calculating interest on the original investment or loan amount, in addition to the interest that has compounded from past periods.

Cash Payback Period

The duration required for an investment to generate cash flows sufficient to recover the initial outlay, measuring the investment's liquidity or risk.

Q28: When the government taxes and spends,each activity

Q76: Banks are required to keep a minimum

Q88: In Figure 10-5,which graph best illustrates the

Q117: Currently in the United States,money is backed

Q143: From the mid-1980s until late 2007,the less

Q146: If inflation rises more quickly in the

Q179: If the MPC increases in value,what will

Q182: Consumer spending is an injection in the

Q199: A single bank is limited in its

Q200: The aggregate supply curve shows for each