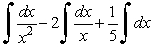

Answer true or false.  =

=  .

.

Definitions:

Average Tax Rate

The percentage of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by total income.

Capital Gains

The profit realized from the sale of assets or investments that have increased in value over their purchase price.

Non-Eligible Dividends

Dividends that do not qualify for the enhanced dividend tax credit in certain jurisdictions, often associated with smaller businesses.

Average Tax Rate

The proportion of total income that an individual or corporation pays in taxes, calculated by dividing the total tax by the taxable income.

Q3: Determine whether or not the following sequence

Q13: Find the average value of f(x) =

Q48: Use the method of disks to find

Q79: Find the interval of convergence for the

Q105: Find the area of the region enclosed

Q145: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6988/.jpg" alt="Evaluate ."

Q215: Use n = 10 to approximate the

Q224: Answer true or false. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6988/.jpg" alt="Answer

Q262: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6988/.jpg" alt="Evaluate ."

Q273: Find the area of the region enclosed